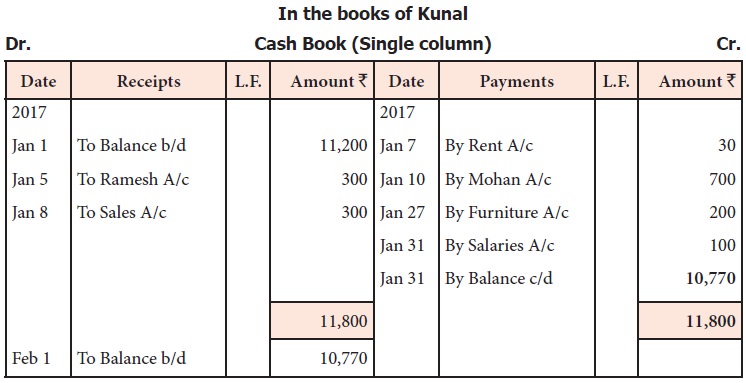

Single column cash book explanation, format and example

February 3, 2022 12:05 pm – Back to News & Offers

By subtracting the required return on equity from net income, analysts can estimate the bank’s economic profit and gain a better understanding of whether it’s generating value over its capital cost. The cash book is maintained in the form of a ledger account, where receipts are put on the debit side and payments on the credit side. A single-column cashbook records only transactions involving the exchange of actual cash in hand. Simply by adding a bank column to both sides of a single column cash book, we can turn it into a double column (or two column) cash book. The cash book, which serves as a journal for the first recording of the cash transactions and also replaces the cash account in a ledger, is called a general cash book.

Where Should We Send Your Answer?

Column WidthsThe Details column is 9cm wide.The other columns are 2.5cm wide – the cash book format looks more balanced if they are the same size. Subsequently, the cash book balances are compared against the bank statements and reconciled in case of discrepancies. This data is then utilised for the preparation of the company’s financial statements.

Do you own a business?

It is crucial to note that Cash Sales are different from Credit Sales. If a buyer pays using credit or debit cards or any other electronic methods of payment, those sales will not be considered ‘Cash Sales’. For those of you who don’t know what “cooked” means, it means the cashbook was adjusted for crooked, personal gain or just outright theft.

Ledger For Accounts Receivable

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A bank account may have an overdrawn balance because by arranging an overdraft with the bank, it is possible that more money may be withdrawn from the bank than what was deposited. If the debit column is larger than the credit column, the difference represents cash at bank.

Operation of Petty Cash

As this explanation indicates, the cash book is among the most important books of accounts in modern business. It should be noted that the amount spent by the petty cashier cannot exceed the amount received. However, two types of cash books are now commonly used for an organization’s aggregate demand. Use these cash book format instructions to make your very own cashbook spreadsheet using plain paper or a school exercise book. The following example summarizes the whole explanation of the triple-column cash book given above. There are a few different types of cash books which all work slightly differently.

By reading this post, you may quickly prepare for accounting courses and for any competitive tests such as school and college exams, vivas, job interviews, and so on. Also, cash being the most crucial element of business requires special attention and monitoring. You can use one page a month, or if the entries are very few for each month, you can do two or three months on one page. You could just buy a school exercise book which already has rows printed in it, so all you have to do is draw in the columns. From the following information, prepare a Simple Petty Cash Book for the month of October, 2022.

- This is ideal if you don’t want to use a computer to keep your cash book and are happy to do it the good old-fashioned manual way.

- Cash books are like diaries, except they only record money coming in and going out, not the juicy details of your love life.

- If a cheque is received and deposited into a bank account on the same date, it will appear on the debit side on the cash book in the bank column.

The single column cash book resembles a T-shaped cash account in almost all respects. An overview of this procedure is given on the double column cash book page. If a cheque is received and deposited into a bank account on the same date, it will appear on the debit side on the cash book in the bank column. To ensure accuracy and avoid discrepancies, it is essential to balance cash books.

A petty cash book is maintained to record small expenses such as postage, stationery, and telegrams. Banks and financial institutions are often challenging to value using traditional cash flow models due to complex capital structures and regulatory requirements. Instead, residual income valuation can be effective because it focuses on accounting-based metrics like book value and net income.

In most businesses, two or three-column cash books (with a bank column) are used to record any transactions made through the bank account. It is also referred to as a three-column cash book format, and it is a complete form with three columns of money on both receipt and payment sides and records transactions about the cash, bank, and discounts. This book is generally maintained cost accounting standards for government contracts by the large firms that do transactions in cash mode and through the bank and frequently allow and receive cash discounts. Single column cash-book contains only the cash transactions done by the business. Single column cash book has only a single money column on debit and credits on both sides. It does not record the transaction-related, which involves banks or discounts.

Cash books are important because their proper maintenance and reconciliation with bank statements are fundamental for a business. During the month of January 2022 following transactions took place in David’s business. Cash is a real monetary instrument like currency, i.e., coins or notes used as a medium of exchange for acquiring goods and services. Book refers to a compiled record of the information available in the written or printed form.

This includes a detailed record of all sources of funds received such as sales proceeds, loan payments, proceeds from investments and so on. Each incoming cash transaction must have supporting documents to back up the amount recorded in the Cash Book. Learn about the different entries you can make in a cash book to keep track of cash transactions. Breaking it down this way helps to understand how a cash book can help you manage cash easily. There are several types of cash books that entities can use, whether they’re businesses or individuals. We’ve highlighted some key details about single-, double-, and triple-column cash books with examples of what each looks like below.