Retail Price vs Selling Price: What’s the Difference

January 27, 2023 4:00 pm – Back to News & Offers

Shocks in the supply chain, geopolitical issues or macroeconomic shifts can all alter the cost landscape. In 2023, the food cupboard segment dominated the food & grocery retail market, shining bright thanks to our newfound passion for home cooking and baking. This is your own calculation of how much it costs you to actually produce one of your (craft) products or art pieces. Further down in the income statement, companies also reveal their operating expenses. These are expenses not directly tied to the production of goods or services. Much as in a traditional KVI world, historical price elasticity remains a critical input for optimizing prices.

Confused about cost price, wholesale price, retail price? Price terminology easily explained for creatives

Selling wholesale is a great way to move lots of product with little effort, at least theoretically. But one challenge that goes into wholesale selling is wholesale pricing. Price too low, and you’ll have little or no profit left over to reinvest into your business.

Organizations in Synder: add clients to your accounting software in a more convenient way

The weighted average cost method helps smooth out price changes, giving a steady cost view. Second, it uses retail prices, not cost prices, for easier calculations. This method makes tracking inventory costs simpler by using markup percentages and retail prices. However, retailers need to focus most on marketing, branding, selling, and customer service. Both wholesale and retail businesses need to spend time managing things like inventory, cash flow, and staff. Retail pricing is set by retailers and is the final selling price for customers.

Retail vs. Wholesale: The Differences Businesses Should Know

Failure to effectively price can lead to rapid loss of customers and margin; however, retailers who build an effective pricing capability can expect lasting top-and bottom-line impact. Beyond pricing, KVIs are often treated differently than non-KVIs across other merchandising levers, including in-store space allocation, safety-stock position, and promotional and marketing activity. The retail method of accounting groups like items into categories to establish a mark-up percent that is then used to determine the cost of goods sold and the value of inventory. This method prevailed when item level costs were difficult to capture and manage; however, with advances in merchandising systems, the retail method is now used for specific business models.

Choosing the right one can greatly affect your inventory management and financial health. When you open a business that sells products, one of the critical decisions you need retail vs cost to make is how you will sell. Or, will you use vendors who distribute your products to their customers? The way you sell determines if your business is retail vs. wholesale.

How to Figure the Selling Price for a Retail Store

If a wholesaler decides to manufacture the goods they sell, they must also be capable of producing in large quantities. And, they must have a manufacturing space large enough to create and store the goods. If you want to succeed as a wholesale investor, you need to have a good relationship with your wholesalers. The more deals you do with them, the better your chances are of getting better pricing.

It’s also worth mentioning that some large retailers often manufacture their bestselling products themselves to profit at each stage of the commerce supply chain. By embracing technology, retailers can enhance their pricing strategies, adapting quickly to market changes and consumer trends. This agility is crucial for maintaining competitiveness and ensuring long-term success in the retail industry. ChappyWrap sells premium blankets directly to consumers via its Shopify website.

- In our example, the cost of goods sold at retail is Sales of $5,300.

- This strategy requires a keen understanding of who the competitors are, the quality of their offerings, and how much consumers are willing to pay for similar products.

- Retailers, on the other hand, specialize in smaller, more individualized transactions.

- Do not share with others (including your retailers or competitors!) It’s nobody’s business how much you want to earn or what your annual costs or overheads are.

- During economic boom periods, consumers are generally willing to part with more cash, which inevitably leads to markups in prices.

- This shows how important it is for companies to carefully consider their pricing strategy, as even a small change can lead to a significant increase in sales.

Wholesaling is the process of buying goods in large quantities from manufacturers or distributors, storing them in warehouses, and then reselling them to retailers for a profit. Learn the major differences between wholesale and retail, with examples and how to choose the best option for your business. Wholesale involves moving goods from manufacturing to distribution, retail involves acquiring goods and selling them to customers.

Inventory valuation in cost accounting is key for accurate financial reports and managing inventory well. This part explains how to calculate inventory costs using the cost method. It also covers the weighted average cost approach and figuring out the ending inventory value. Again, the prices wholesalers give to retailers are generally much lower than the prices the end-users see. But, both wholesale and retail business owners must factor in profit margins and markup costs when determining their prices. While there is a difference between wholesale and retail prices, both types of businesses should still review their margin vs. markup.

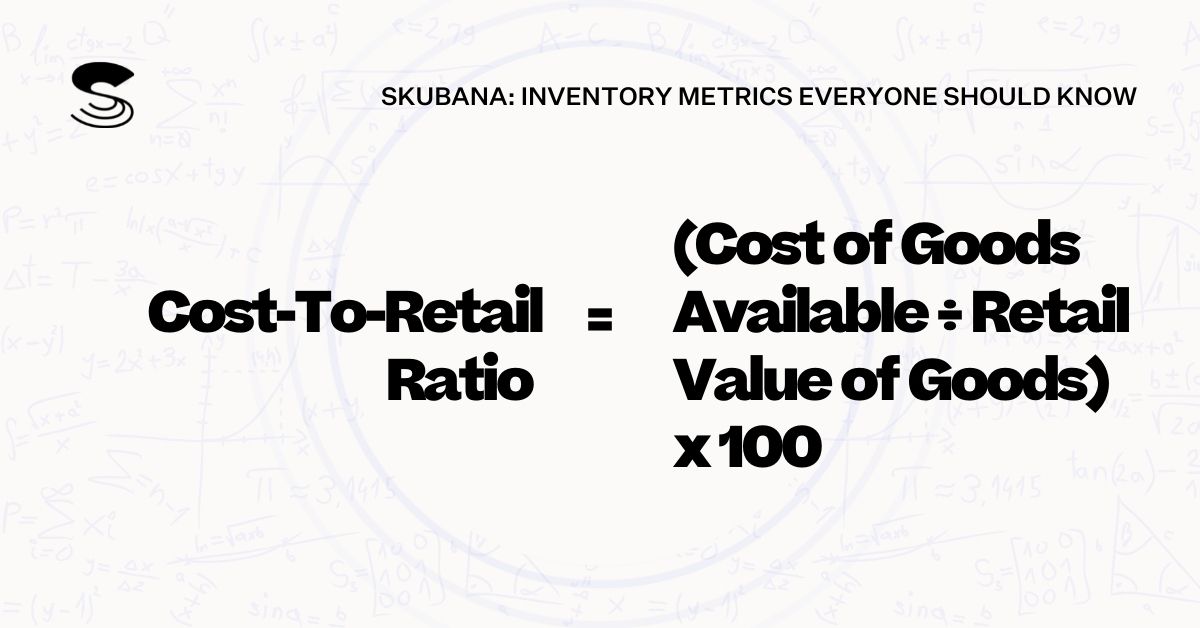

Also, since it’s an estimate, it’s hard to give an exact figure using this technique. If you sell online using PayPal, Stripe, or Square, you might not need a separate POS. Instead, you can set up a smart auto-tracker in the background to instantly enter all changes into your ecommerce accounting software after a sale. For instance, if a pair of shoes costs $40 to manufacture and retailers sell them for $100 each, the cost-to-retail ratio is 40% (or $40/$100) when expressed as a percentage.